us germany tax treaty summary

Before you run out and file this form talk to a Tax Advisor. To claim it youd file Form 8833 and include your situation in the summary.

Us Expat Taxes For Americans Living In Germany Bright Tax

Germany has the largest economy and is the second most populous nation after Russia in Europe.

. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. Protect against the risk of double taxation where the same income is taxable in 2 states. Germany is a key member of the European economic political and defence organisations.

Article 24 of the USUK. The official language of Germany is German and the currency is the euro EUR. Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US taxes on certain items of income they receive from sources within the United States.

Tax treaty for example would help alleviate this particular situation. You must compute a separate foreign tax credit limitation for any such income for which you claim benefits under a treaty using a separate Form 1116 Foreign Tax Credit for each amount of resourced income from a treaty country. Tax benefits you get from treaties dont have to be claimed with Form 8833.

The majority of USUK. See Internal Revenue Code sections 865h 904d6 and 904h10 and the regulations under those sections. The United States has tax treaties with a number of foreign countries.

If a tax treaty between the United States and your country provides an exemption from or a reduced rate of withholding for certain items of income you should notify the payor of the income the withholding agent of. Individuals paid capital gains tax at their highest marginal rate of income tax 0 10 20 or 40 in the tax year 20078 but from 6 April 1998 were able to claim a taper relief which reduced the amount of a gain that is subject to capital gains tax thus reducing the effective rate of tax depending on whether the asset is a business asset. Double taxation treaties are agreements between 2 states which are designed to.

For more details on the whether a tax treaty between the United States and a particular country offers a reduced rate of or possibly a complete exemption from US. Income tax for residents of that particular country refer to. It is divided into 16 provinces and its capital is Berlin.

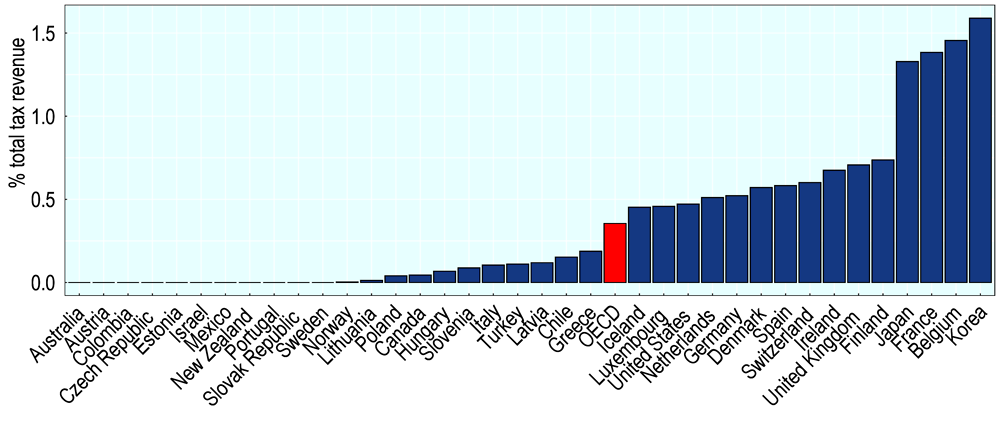

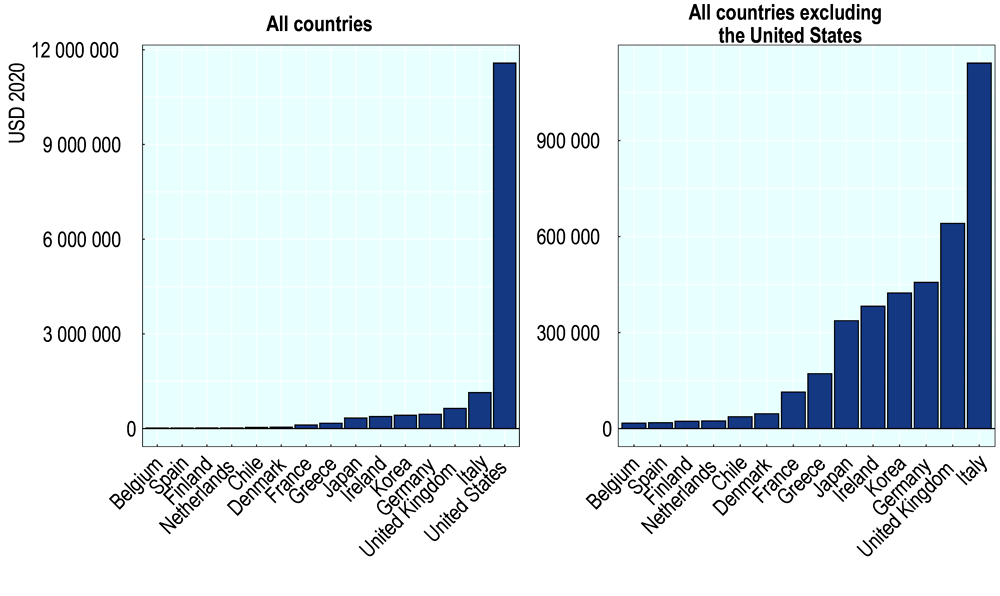

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

German Law Removes Us S Corporation Tax Benefit

Latvia Tax Income Taxes In Latvia Tax Foundation

U S Estate Planning For Nonresident Aliens From Treaty Countries A Comparison Of Germany Austria France And The United Kingdom Lexology

German Law Removes Us S Corporation Tax Benefit

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Us Expat Taxes For Americans Living In Germany Bright Tax